Creditors to the debt-laden Lavasa Corporation have decided to extend the deadline for the resolution process, giving bidders another chance to increase their bids for the real estate venture. The extension was forced after one of the bidders, Valor Estate, submitted an improved revised plan beyond the deadline, people familiar with the matter said.

Lenders will meet again on Friday to decide the new deadline for all bidders to submit revised bids, with a likely extension by another two months beyond the August 29 deadline, they said.

“After almost a week of debate lenders have concluded that the Valor bid must be accepted, which means that they have to give other bidders another chance to increase their offer. The new bidding timeline will be decided when lenders meet on Friday,” said one of the persons, who did not wish to be identified.

Mumbai-based Yogayatan Group had emerged as the highest bidder for Lavasa Corporation with a bid of Rs 795 crore on a net present value (NPV) basis, beating the Rs 776 crore bid by Welspun and a Rs 771 bid by Valor Estate late last month. These were improved offers after the first round of bidding earlier this month.

However, Valor Estate, which had not placed a revised bid, said it wanted to increase its bid after the final bids were opened. The Mumbai-based company has offered to increase its bid to Rs 806 crore on an NPV basis.

A Valor Estate spokesperson said, “As per the process note, bids submitted under the Challenge Process were meant to be final and binding. We adhered to these guidelines, but other bidders were allowed to revise their bids after our numbers became public, which created an uneven playing field. While we’ve received no formal communication on any rebid, we believe corrective steps were necessary to restore transparency and ensure fairness for all bidders.”

One of the persons cited earlier said lenders were supposed to put all the bids for voting from August 4 but the Valor Estate bid outside the deadline complicated things. “From lenders’ perspective, they do not want any litigation in the future and also want to maximise their recovery, so everyone will be given another chance to increase their offers and the NCLT (National Company Law Tribunal) will also be petitioned to extend the resolution process timeline,” the person said.

The lenders’ decision to extend the deadline has caused heartburn among other bidders.

“There is no sanctity of the bidding process if bidding is being reopened just because only one bidder wants to increase his bid. We may not participate in the next round,” one of the bidders said on condition of anonymity.

Homebuyers have also opposed the extension, highlighting that the resolution process was in its seventh year. “Permitting post-deadline revisions in the resolution plans renders the entire CIRP (corporate insolvency resolution process) arbitrary, encouraging delaying tactics and forum shopping by certain errant resolution applicants who may be delaying the revival of Lavasa,” homebuyers said in a letter to the resolution professional.

Queries emailed to EY-backed resolution professional Udayraj Patwardhan did not elicit a response.

Union Bank of India is the lead lender, with 12% of total dues. Phoenix ARC is the second largest creditor, with close to 11% of total debt, which it had bought from L&T Finance in 2023, just before DPIL’s plan was approved by the NCLT in July 2023. Also owning more than 10% is another bad loan aggregator Arcil. Bank of India and Axis Bank are the other large creditors owning more than 8% of the debt each.

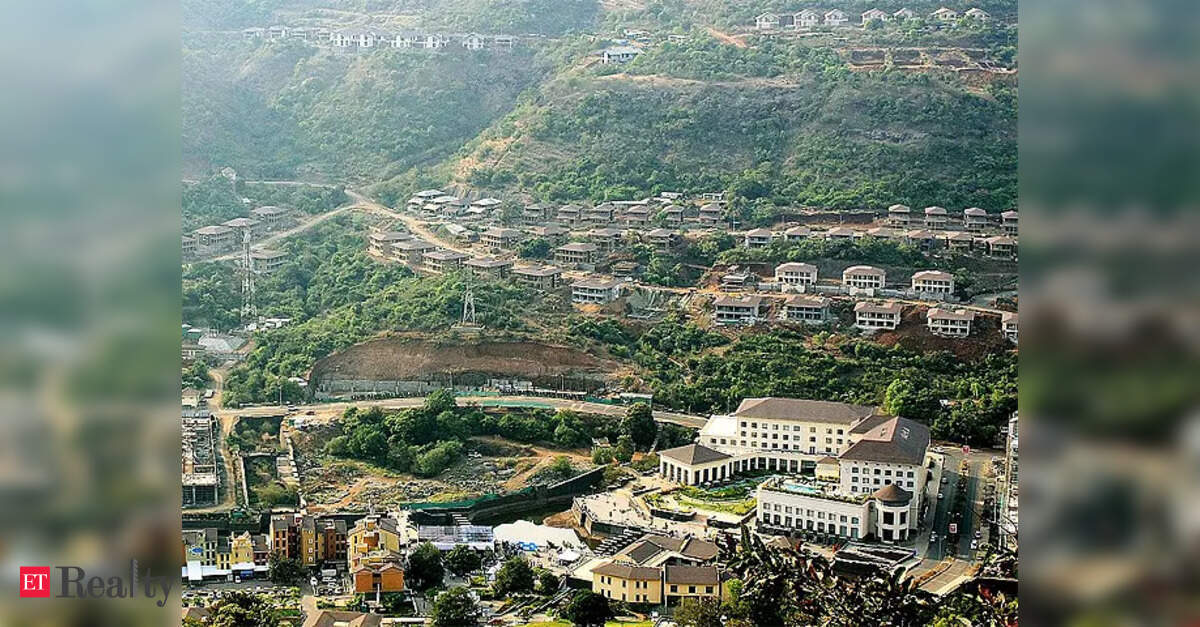

Lavasa Corporation was promoted as India’s first privately built and managed city at the turn of the century, targeting affluent people from Mumbai and Pune wanting to escape the noise and pollution of their cities. Modelled after the Italian fishing village Portofino, it was planned like a gated city with space for a golf course, rowing and even a football academy. However, it went bust and was admitted to bankruptcy in 2018.

- Published On Aug 7, 2025 at 09:41 AM IST

Join the community of 2M+ industry professionals.

Subscribe to Newsletter to get latest insights & analysis in your inbox.

All about ETRealty industry right on your smartphone!